A New Talent Landscape

Securing Talent for Growth in the era of Solopreneurs, Remote Work and Anywhere Jobs

Grantley Morgan

Originally posted in September 2021

Since I started my New Work Odyssey series in February 2021, structural shifts have continued to reshape the global economy and its component labour markets. Talent shortages are emerging, workers are simultaneously seeking change in record numbers, and yet the mismatch between current and desired skills threatens to slow the speed of growth.

In the scramble for productive capacity, we must also manage the long-term implications of digital transformation – which for some include the looming risk of a new wave of de-industrialisation impacting professional white-collar work in developed economies. Automation also has broad applicability across sectors, with the Covid-19 investment wave likely to continue as a forerunner to greater digital capacity.

A Roaring ’20s style recovery is likely to demand faster, flatter, more agile organisations that can quickly reallocate talent to new work in pursuit of growth. The defining challenge for talent strategists is to achieve that whilst mitigating the potential consequences of occupational shifts and economic dislocation. To win whilst promoting sustainable outcomes.

Let’s explore what’s going on and how to respond in 3 parts:

- Where is all the talent? Signals of tightening labour markets

- What does our new talent landscape look like?

- Five steps to talent sustainability

Where is all the talent? Signals of tightening labour markets

First, lets set a frame for our exploration of the new talent landscape. Readers of ‘A New Work Odyssey’ will perhaps recall that Covid-19 initially resulted an 8.8% working-hour loss in 2020, as per the ILO’s estimates. The picture in H1 2021 is inherently more optimistic, though securing talent is becoming more difficult as the balance swings from capital to labour. Choices are starting to reflect our changing attitudes to work and technology.

Signal 1:

Hiring intent is up in 42 of 43 countries covered by ManpowerGroup’s Q3 2021 Employment Outlook Survey. The strongest hiring prospects are reported in the US (+25%), Taiwan (+24%) and Australia (+17%).

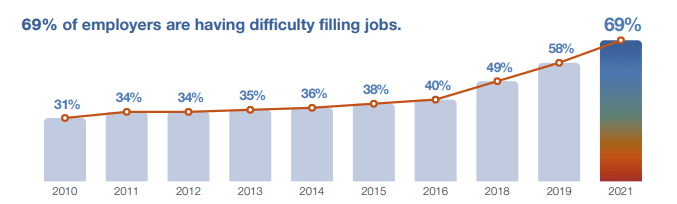

However, the first sign of a talent shortage also emerged: a record proportion of employers report difficulty filling jobs, with every indication this is a global problem.

These hiring intentions come on top of many jobs created to help respond to and manage the pandemic. These include new and usually well-paid government jobs linked to Covid testing, tracing and support activities; together with surge resourcing that has gone into healthcare, social care and food retail settings. In the case of surge resourcing, lay-offs from wider retail, hospitality and travel sectors led workers into temporary work – hiring difficulties in those sectors may stem from workers remaining in their surge roles in the short-to-medium term.

Signal 2:

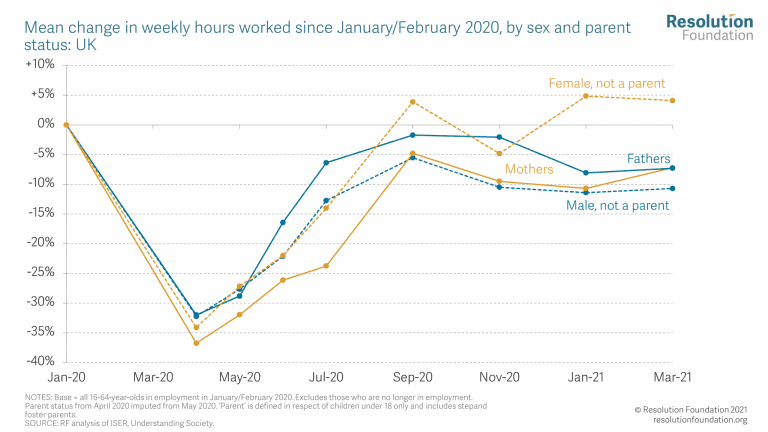

Childcare / caregiver responsibilities are still keeping people, particularly women, out of work. In the UK, mothers’ working hours fell most while schools were closed, before steadily returning closer to normal levels. Ongoing health fears for some could continue to slow the rate of return.

Signal 3:

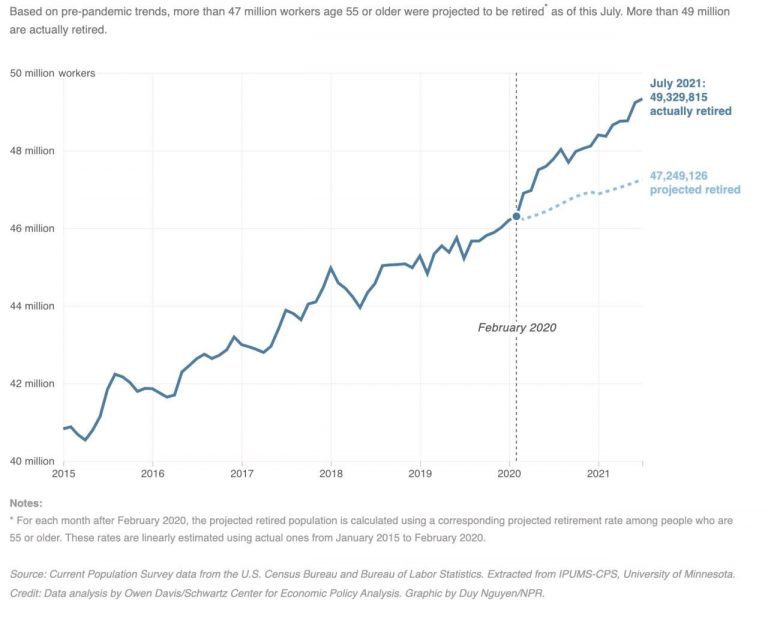

Above-expected retirement rates stimulated by Covid-19. 2m more Boomers retired in the US since February 2020 than projected. If this trend is repeated in countries where the labour force is already shrinking, like China and Germany, talent shortages will intensify.

Signal 4:

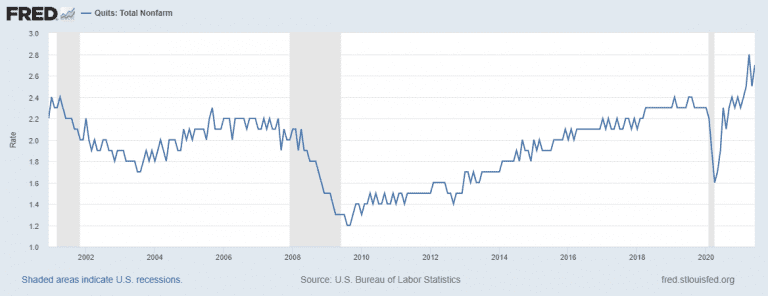

The Quit Rate finally shows up, signalling a desire for new forms of work. US resignation rates reached record levels each month between March-June 2021 inclusive, setting an all-time record of 2.8% in April. The Great Resignation begins?

Signal 5:

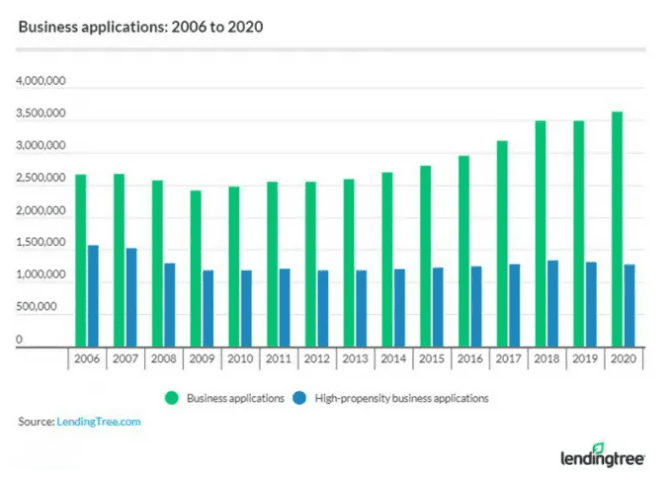

The march of the Solopreneur. Despite the impact of a global recession, US new business applications reached record levels in 2020, stimulated by the CARES Act. The largest category was, unsurprisingly, e-commerce.

A recent Forerunner survey found that 35% of all US respondents are more interested in working for themselves after Covid. Many US commentators, including Barry Ritholtz, consider this in part down to an unlocked desire for greater autonomy and control over what work they do, when, how and why. We’ll return to this topic later.

Signal 6:

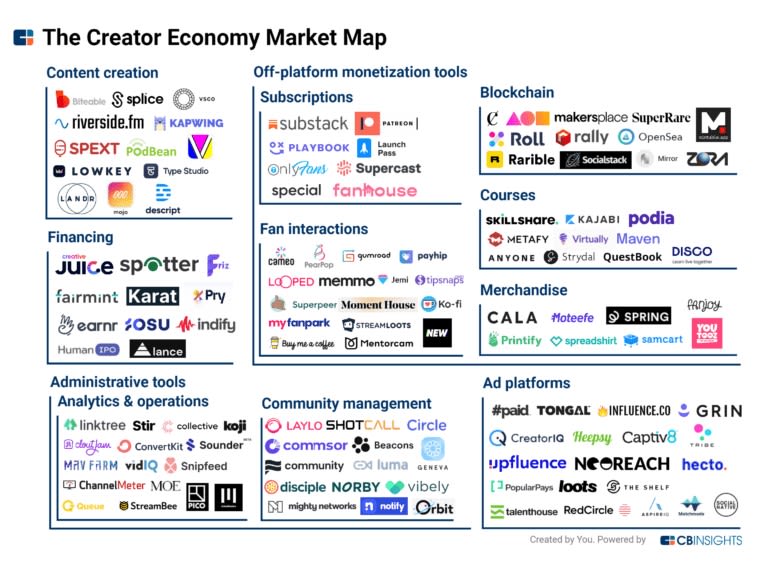

The rapid rise of the creator economy. New platforms are making content creation and monetization easier. Covid-related furlough schemes may have given people the time to turn passion plays into income streams, whether as part of a work portfolio or as a job substitute.

These signals all indicate (1) an overall reduction in the active labour force, and (2) adoption of new jobs or forms of work at an accelerated rate. They represent underlying changes in attitudes and preferences, fuelled by technology, lifestyle and economic choices – the impact of which could be either temporary or transformative.

Next, we’ll look at the emergence of a new class of jobs and the potential implications of a new wave of globalisation.

What does the new talent landscape look like?

The post-Covid talent landscape can be characterised by Anywhere Jobs, expanding talent ecosystems, and the potential of automation & AI as capacity-enhancing technologies.

‘Anywhere Jobs’

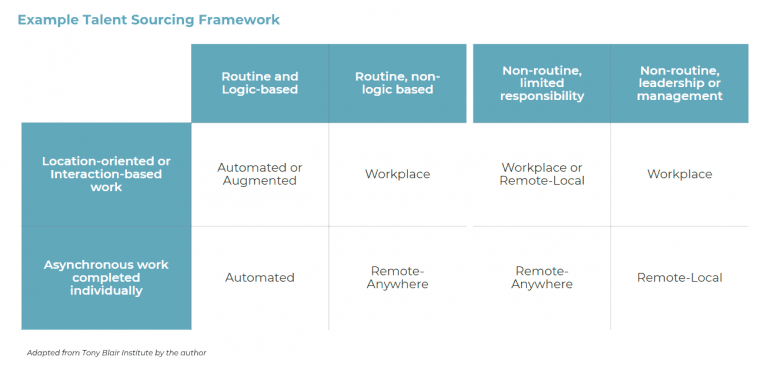

Work by the Tony Blair Institute (TBI) to explore the impact of rapid digitisation and adoption of remote working technologies through the pandemic identified a new class of work vulnerable to outsourcing and offshoring. ‘Anywhere Jobs‘ are those containing asynchronous and detailed tasks, requiring limited physical activity, and holding limited responsibility. Examples include Graphic Designers, Accountants and Software Engineers. 1 in 5 UK jobs meets the criteria, or some 6m of the current labour force.

The concern for policy makers at the TBI is that these jobs could represent opportunities to (1) make labour a variable cost through use of freelancers or contractors; and/or (2) recruit from wider geographic areas or talent pools. Both outcomes can be considered an opportunity and a risk to workers, companies and indeed nations. Opportunities include access to work or talent outside of major ‘hub’ cities, spreading growth. Risks include the propensity for job losses if talent shortages persist or competing nations attract work (all else held equal).

The authors present Anchors and Accelerants across 5 criteria, informing location strategies that go beyond economic and labour-related factors, adding social and cultural aspects as foundations of great jobs and places to work/live.

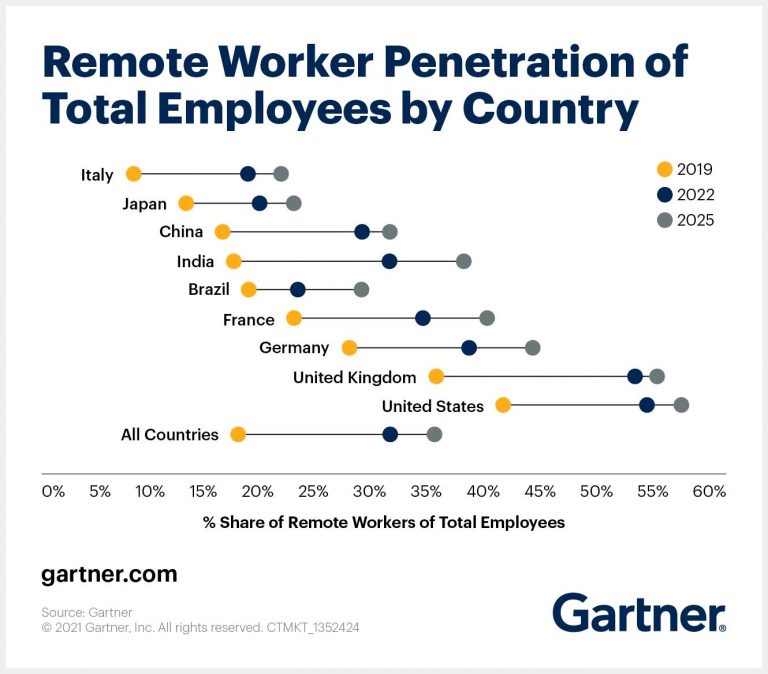

The permanency of remote work is underlined by Gartner’s 4 year outlook, with almost double the number of employees expected to be remote workers in 2025 compared with 2019.

The loosening of the link between job and geography for such a broad range of jobs brings with it opportunities that should be managed carefully. Companies seeking to scale or grow rapidly may choose to expand talent ecosystems globally with use of freelance or contract labour. Those seeking to specialise locally may be competing with more companies for local talent. In both scenarios, support systems and infrastructure including broadband, connectivity, housing and childcare will determine success as much as access to deep talent pools and hybrid leadership capabilities.

Expanding talent ecosystems

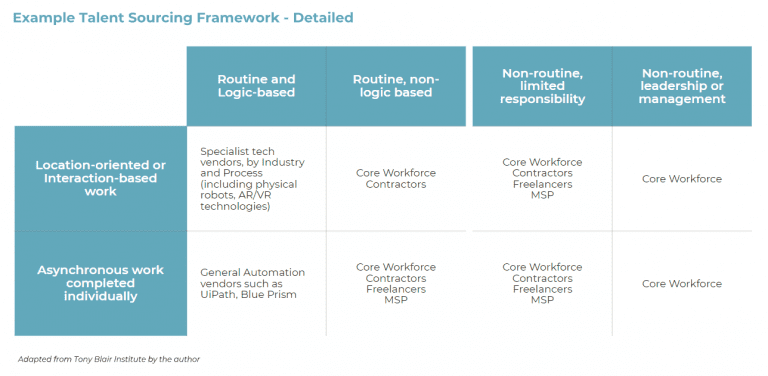

Three forces coalesce towards an updated sourcing framework for companies seeking to increase capacity: the prevalence of talent shortages, accelerated investment in digital technologies and worker preferences for hybrid work. Adapted from TBI, this illustrates how sourcing preferences could be set within an ecosystem of 5 talent categories, depending on the nature and proximity of the work.

We can further break down the 5 talent categories into heavily-simplified sourcing sub-categories, within which it’s easy to consider the proliferation of local labour market alternatives the TBI is concerned about.

Companies face a hard choice in terms of speed of execution – keeping a larger proportion of jobs within the markets they are headquartered or serve may be preferential, but will it be preferential to growth if talent shortages or skilling delays perpetuate? Planning for talent needs in 2-3 years is difficult when faced with shortages now, however it could enable better labour outcomes in developed markets for the next decade. Collaborative governments should prioritise infrastructure improvement, R&D incentives and tax credits for skilling, to benefit from this new class of jobs.

Capacity enhancing technologies

Perhaps its no surprise that digital investments continue to accelerate, given the talent shortages we’ve considered and wider concerns regarding supply chain resilience following the impact of Covid and particularly the Delta variant in 2021. Indeed, from my collated summary of 2021 client challenges, we can see 3 of the 4 themes are to some extent determined or enabled by technology.

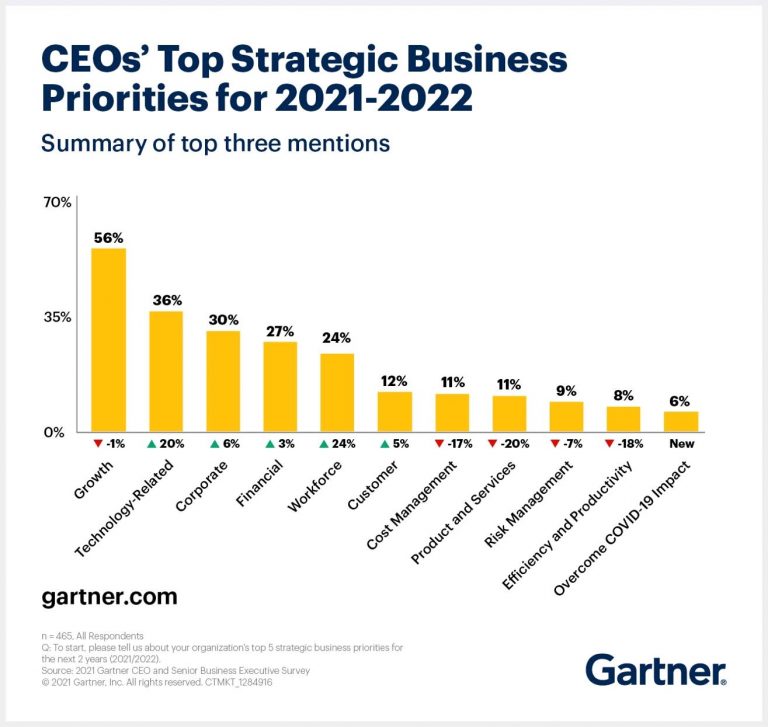

From Gartner’s latest research, CEOs also continue to prioritise Technology second to, and likely in pursuit of, Growth.

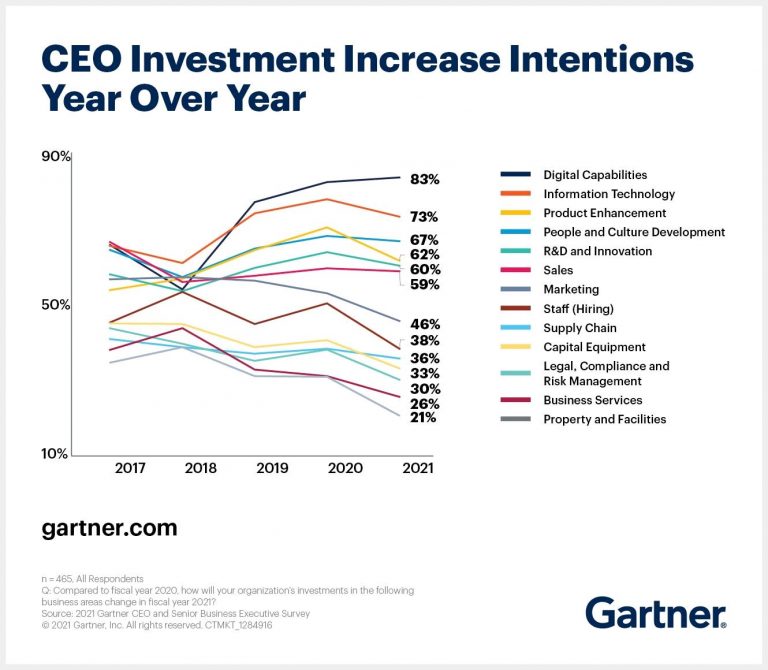

From the same research, a glance at CEOs’ top 3 investment priorities shows that moving workforces further ahead of the technology curve has to remain firmly in our view despite the short-term talent challenges stacking up.

Inherently, the new talent landscape will transform the way we design jobs and teams, recruit talent, configure workspaces, learn, and manage performance/productivity. It is no longer sufficient to compete on salaries alone. Today’s talent is motivated by a range of factors including but not limited to salary – location, learning opportunities, culture and purpose all feature. Success depends on engaging meaningfully with talent throughout the lifecycle and empowering people to work where they are best.

Five steps to talent sustainability

To win whilst promoting sustainable talent outcomes is a question of workforce evolution at speed and scale. Amidst all the labour market signals, scenarios and emerging priorities, what are the talent strategy, operating model and culture implications for today’s corporates?

Consider 5 steps to evolve your workforce within the new talent landscape:

- Reshape work with input from your employees, offering personalisation (“how would you like to spend your time?”) while figuring out how to re-bundle activities from jobs to squads productively. Prioritise automation investments where activities can be augmented to increase capacity. In tandem with this redesign effort, identify the skills needed to perform the work over 2-3 years.

- Rethink who does the work when forming your squads. Consider what work can and should be delivered through talent marketplaces and partnerships. Pulse check if your hiring strategies are successfully (re)activating impacted talent segments, such as women and neurodiverse groups.

- Reconfigure where work gets done, adapting location strategies and workspace design to incubate multiple constituents of your talent ecosystem or supply chain. Also consider the cultural enablers of hybrid work, including leadership and management capabilities.

- Reconnect employees with your purpose, giving them the time and space to form cross-disciplinary teams that fulfil important missions or projects (think of these as squads or tribes tasked with future-proofing your business).

- Revolutionise how people learn, creating (1) personalised learning options with deep relevance to their (future) work and (2) peer-to-peer learning communities within and beyond your organisation, providing people with the opportunity to build the skills that will drive growth.

There’s no doubting the pandemic has brought lasting impacts with a very broad reach across the labour market. When the temporary signals subside, we’ll be left with a tightening labour market that risks delaying growth. Anywhere Jobs increase the number of options available in search of productive capacity, but also increase the number of factors we need to account for in business and talent strategies – with potentially difficult trade-offs.

More profoundly, the death of the lifetime employment contract and the after-effects of the Coronavirus pandemic are antecedents of a move from secure to dynamic work. After mustering the resilience to see off the travails of furloughs, lay-offs, remote work and home schooling, we all want to do more of what we love post-pandemic. Today’s signals give us every indication people will make change independently if we don’t show a compelling opportunity narrative for what work they’ll do, where, with whom, and by building which skills.

What a fascinating time to be in Talent Consulting. I’m looking forward to the journey ahead.

With optimism,

GM

September 2021